Purchasing your first home is an exhilarating journey, but it comes with its fair share of challenges. we uncover the 10 most common mistakes that first-time home buyers often make. From financial missteps to overlooking crucial details, we shed light on these pitfalls so that you can approach your home-buying journey with confidence and knowledge.

Ignoring the Importance of Credit

A strong credit score is essential for securing a favorable mortgage. Neglecting credit health can lead to higher interest rates or even a loan denial.

Skipping Pre-Approval

Failing to obtain a mortgage pre-approval can hinder your negotiation power and result in disappointment.

Underestimating Budgets and Costs

Miscalculating expenses beyond the purchase price, such as maintenance, taxes, and insurance, can strain your finances.

Foregoing Professional Help

Not enlisting the expertise of a real estate agent or attorney can lead to legal or financial complications.

Overlooking Hidden Expenses

From closing costs to home inspections, there are hidden expenses that can catch you off guard if not accounted for.

Getting Emotionally Attached Too Quickly

Falling in love with property too soon can cloud judgment and lead to rash decisions.

Neglecting Location Research

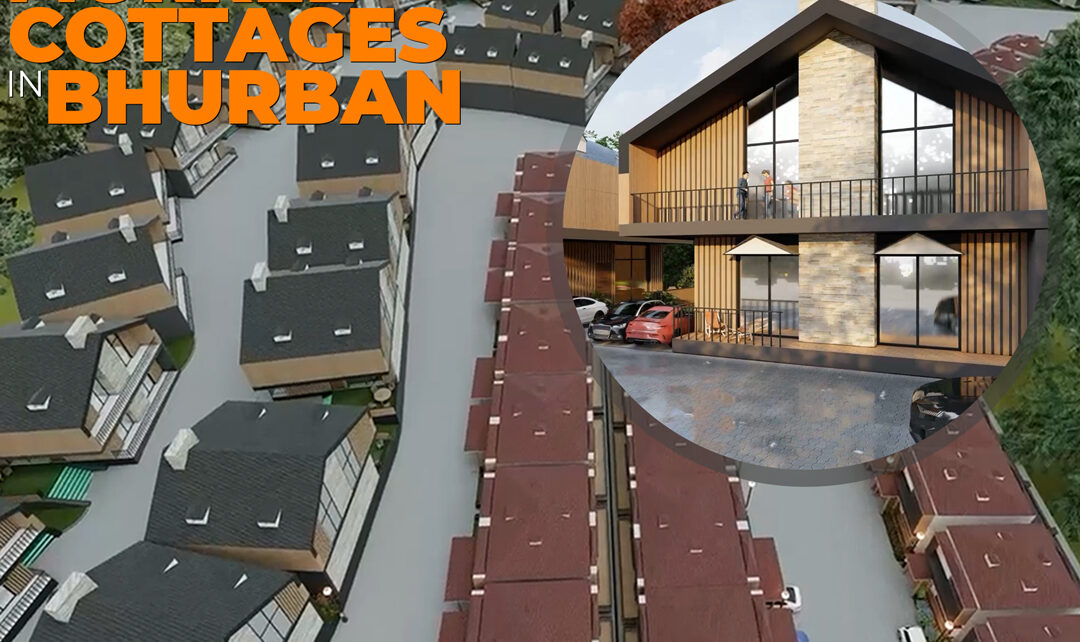

Overlooking the importance of neighborhood research can lead to dissatisfaction with your chosen location, and Bhurban Meadows provides luxury cottages in Bhurban.

Not Factoring in Future Needs

Choosing a home that doesn’t meet your future needs, such as family expansion, can lead to outgrowing your space quickly.

Skipping Home Inspections

Failing to conduct a thorough home inspection can result in unexpected and costly repairs.

Not Reading the Fine Print

Rushing through contracts and agreements without reading the fine print can lead to misunderstandings and regret.

Navigating the path to homeownership requires informed decision-making. By recognizing and avoiding these common mistakes, first-time home buyers can embark on their journey with greater clarity and preparedness. Consulting professionals, conducting due diligence, and approaching the process with patience will empower you to make sound choices and lay the foundation for a successful and fulfilling homeownership experience.