Running a business in today’s fast-paced world requires efficiency, accuracy, and smart decision-making. For startups and small-to-medium enterprises (SMEs), managing human resources can be particularly challenging. Payroll management—one of the most critical aspects of HR—often becomes time-consuming and error-prone when done manually. This is where payroll software in India comes into play. By automating salary processing, tax deductions, compliance, and employee records, payroll software helps startups and SMEs save valuable time, reduce costs, and focus on growth.

In this blog, we’ll explore why payroll software is no longer a luxury but a necessity for startups and SMEs in India.

Challenges Startups and SMEs Face with Payroll

Before diving into the benefits of payroll software, it’s important to understand why manual payroll management is so difficult for smaller businesses.

- Complex Salary Structures

Startups often employ staff with different pay structures—full-time, part-time, consultants, and interns. Managing varied salaries manually can cause confusion and errors. - Compliance Burden

Indian companies must comply with multiple statutory regulations like PF, ESI, TDS, and professional tax. Missing deadlines or miscalculations can result in penalties. - Resource Constraints

SMEs generally have small HR teams—or sometimes no dedicated HR staff at all. This makes payroll management a heavy burden on business owners. - Employee Dissatisfaction

Delayed or incorrect salaries quickly lead to unhappy employees, high attrition, and a damaged reputation for the company. - Lack of Transparency

Without a proper system, employees cannot easily access payslips, tax statements, or leave balances, leading to constant queries and inefficiency.

Clearly, traditional payroll methods don’t support the dynamic needs of modern startups and SMEs. That’s why investing in payroll software is so essential.

Why Payroll Software in India is Essential

1. Accuracy in Salary Processing

Manual payroll calculations are prone to errors, especially when businesses have different types of employees. Payroll software ensures 100% accurate salary disbursements by automatically calculating salaries, bonuses, deductions, and reimbursements. This accuracy builds employee trust and prevents financial discrepancies.

2. Automated Compliance Management

One of the biggest advantages of payroll software in India is its ability to handle compliance with Indian labor laws. The software stays updated with the latest regulations and automates statutory deductions like:

- Provident Fund (PF)

- Employee State Insurance (ESI)

- Tax Deducted at Source (TDS)

- Professional Tax

This eliminates the risk of penalties and saves HR teams countless hours.

3. Time and Cost Savings

For startups and SMEs, every minute and rupee counts. Automating payroll reduces the workload on HR staff, allowing them to focus on strategic tasks like hiring, employee engagement, and training. Additionally, it cuts down costs by reducing the need for manual effort and external consultants.

4. Scalability for Growing Businesses

Startups may begin with a handful of employees but grow rapidly within a few years. Payroll software can easily scale with the business, handling everything from 10 employees to thousands without additional complexity.

5. Employee Self-Service Portals

Most modern payroll software comes with self-service portals where employees can:

- Download payslips.

- Check leave balances.

- Access tax forms.

- Update personal information.

This reduces repetitive queries for HR staff and empowers employees to access information instantly.

6. Integration with HR and Accounting Systems

Payroll software integrates seamlessly with HR management systems (HRMS) and accounting tools. This ensures smooth data flow across recruitment, attendance, leave, and finance functions—eliminating silos and improving efficiency.

7. Enhanced Data Security

Payroll data contains sensitive employee information. Reputable payroll software uses encryption and access controls to secure data, ensuring compliance with data protection regulations.

8. Faster and Smarter Decision-Making

Payroll software provides detailed reports on salary distribution, compliance, overtime costs, and more. For startups and SMEs, this data is crucial in making smarter financial and HR decisions.

Features to Look for in Payroll Software in India

When choosing payroll software, startups and SMEs should prioritize the following features:

- Automated salary calculations.

- Statutory compliance updates.

- Employee self-service access.

- Integration with biometric attendance systems.

- Cloud-based access for remote teams.

- Mobile app support.

- Scalability to support future growth.

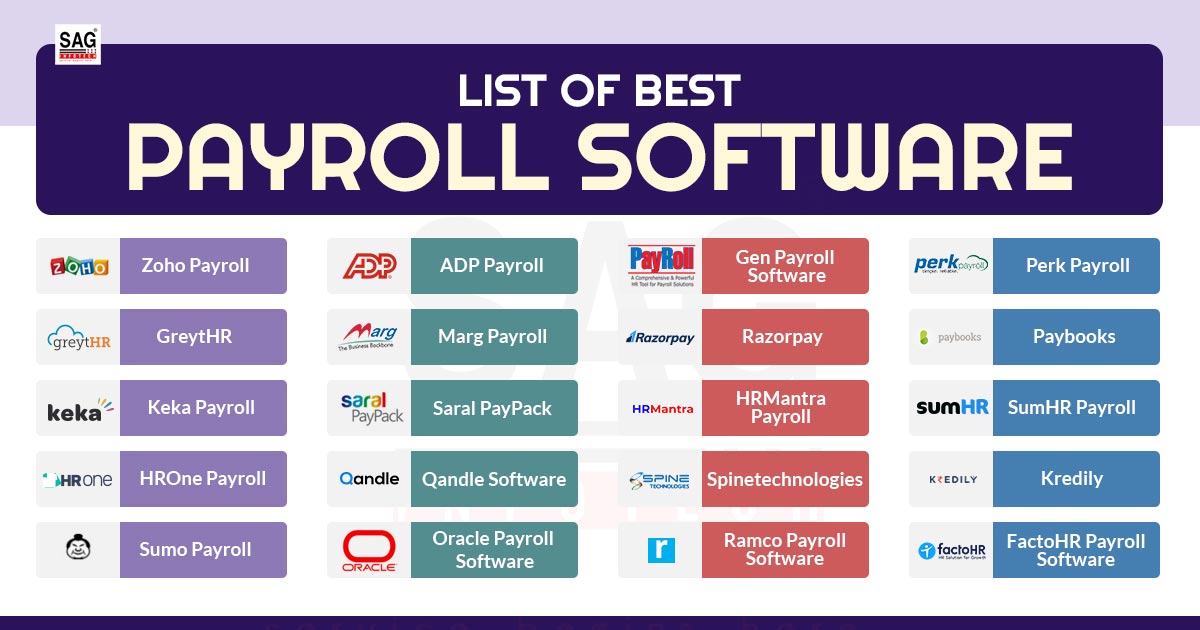

Popular Payroll Software in India for Startups and SMEs

Here are some of the leading payroll software solutions tailored for small businesses in India:

- greytHR – Affordable and widely used for payroll and compliance automation.

- Keka HR – User-friendly with strong payroll and performance management tools.

- Zoho Payroll – Simple, cloud-based payroll solution for SMEs.

- Zimyo – Offers payroll along with employee engagement features.

- factoHR – Scalable payroll and compliance software with mobile-first access.

These solutions provide startups and SMEs with cost-effective, reliable payroll management systems.

Case Study: How Payroll Software Helps Startups

Imagine a tech startup with 25 employees. Initially, the founder manages payroll using spreadsheets, but as the team grows, errors increase—leading to delayed salaries and compliance issues. Employees are dissatisfied, and the HR workload becomes overwhelming.

After adopting payroll software, the startup automates:

- Salary processing.

- PF and ESI deductions.

- TDS compliance.

- Payslip generation.

Within months, employee satisfaction improves, compliance errors disappear, and the HR team can focus on recruitment and culture building instead of manual calculations.

This example highlights how payroll software directly supports business growth.

The Future of Payroll Software in India

By 2025, payroll software is expected to become even smarter with:

- AI-powered analytics to forecast payroll expenses.

- Blockchain-based security for sensitive salary data.

- Mobile-first solutions for startups managing remote teams.

- Integration with financial wellness programs to support employees’ personal finance management.

For startups and SMEs, these innovations will make payroll management even more efficient, secure, and employee-friendly.

Conclusion

For startups and SMEs, payroll management is not just about calculating salaries—it’s about building trust, ensuring compliance, and supporting business growth. Manual methods are inefficient, error-prone, and unsustainable in the long run.

Implementing payroll software in India empowers businesses to automate salary processing, ensure compliance with regulations, improve employee satisfaction, and save valuable time and money. Whether you’re a startup with 10 employees or an SME with 200, payroll software is no longer optional—it’s an essential investment for growth and success.

By adopting the right payroll solution, startups and SMEs can focus on what matters most: building innovative products, delivering value to customers, and scaling their businesses with confidence.